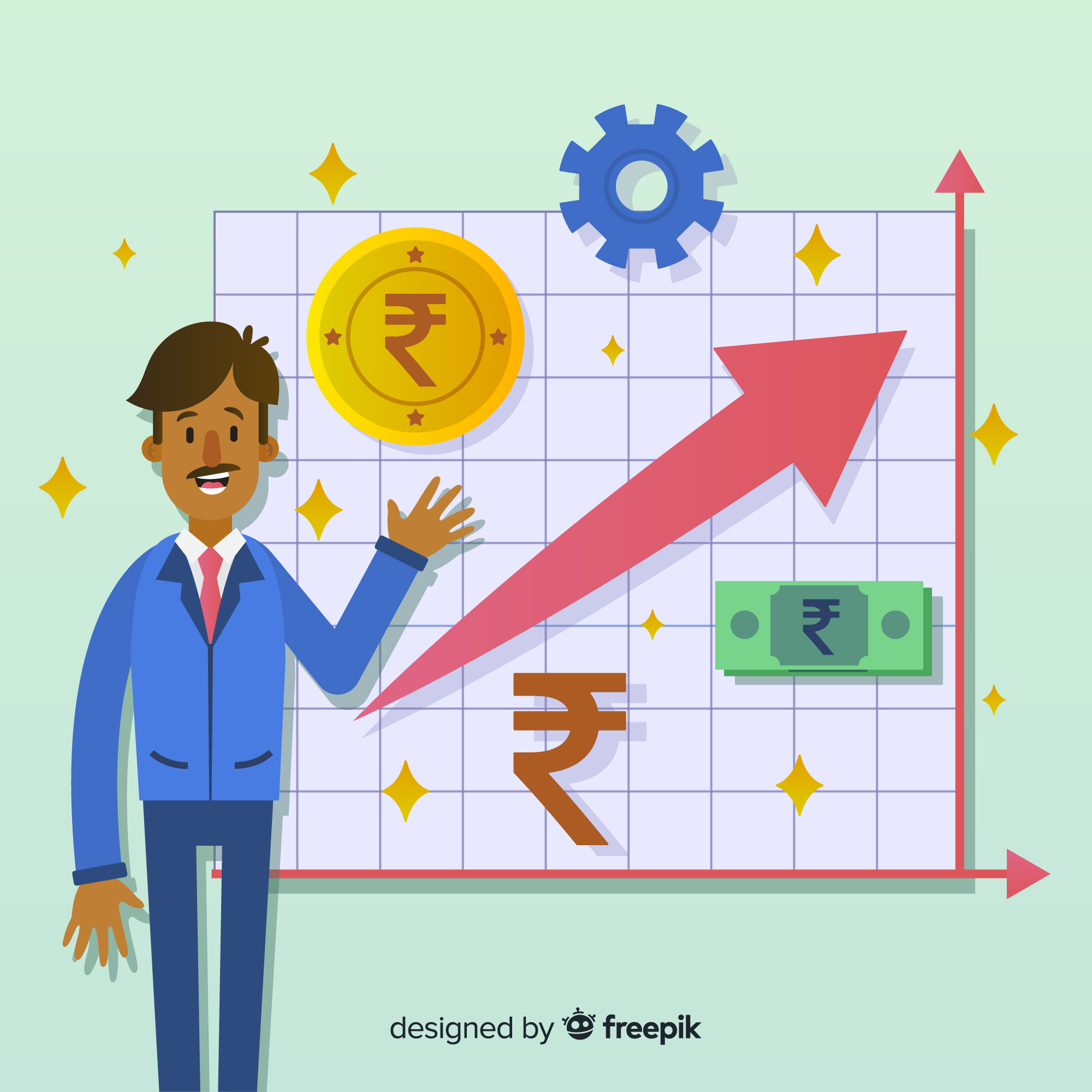

RBI Launches ₹25,000 Crore G-Sec Buyback to Manage Debt and Support Markets

Mumbai, July 12, 2025 – The Reserve Bank of India (RBI) has announced a ₹25,000 crore buyback auction involving three government securities, scheduled for July 17, 2025. This marks the third such operation in the current financial year as authorities work to optimise the debt profile and cushion market stability amid volatile economic conditions.

What’s Being Bought Back?

The auction targets three dated government securities, all maturing in April 2026, with coupon rates of 7.27%, 5.63%, and 6.99%. Though notified at ₹25,000 crore, the RBI may scale operations based on bidding response, following its strategy in earlier auctions where acceptances almost matched demand.

This is a debt management tool—by buying back short-run bonds, the government lowers its upcoming repayment obligations while boosting bond-market liquidity.

Why This Move Matters

- Debt Reduction: Refinancing maturing bonds reduces gross borrowing in the next fiscal year, helping control both cash outflows and headline fiscal deficits.

- Yield Stability: Buybacks absorb excess liquidity, easing downward pressure on yields and preventing sharp market dislocations, critical in the current uncertain global backdrop.

- Systemic Liquidity Management: Historically, buybacks have injected “durable liquidity” into the banking system, helping RBI fine-tune short-term rates without broad overnight adjustments.

Context: This Fiscal Year’s Bond Operations

- Previous Auctions: In June, RBI held two auctions—₹26,000 crore and ₹25,000 crore—attracting strong demand. In June’s second auction, bids reached ₹53,031 crore, with ₹25,700 crore accepted.

- Upcoming Buyback: Today’s ₹25,000 crore announcement brings the total buyback budget for FY 2025–26 to over ₹76,000 crore.

Yield Curve Calibration: By reducing near-term supply, this move is intended to smooth out peaks in the yield curve—especially as the fiscal year-end approaches.

Market Perspective

- Strong Demand Expected: With previous auctions oversubscribed, market players anticipate similar enthusiasm for this round.

- Yield Impact: While buybacks often support bond prices, the extent depends on RBI’s acceptance of bids versus notifications.

- Bond Investor Sentiment: Dealers and banks view this as RBI signaling its readiness to stabilise markets ahead of potential reintroductions of government securities later this year.

Broader Economic Implications

- Fiscal Stability: By pre-emptively repaying shorter-term bonds, the government lowers rollover risk in the next fiscal session—an important signal to fiscal markets.

- Structural Liquidity Management: Managed reductions in debt issuance and calibrated mopping-up help balance growth targets with inflation control.

- Global Positioning: As developed economies unwind massive stimulus, India’s approach displays maturity—using strategic buybacks to manage yield risks while avoiding broad liquidity shocks.

What to Watch Post-Auction

- Auction Results: Day-of demand vs. notified amount and RBI acceptance rates.

- Yield Movement: Reaction across 1–5 year G-Sec yields.

- Next Steps: Follow-up announcements from RBI on similar operations or term repo actions.

- Fiscal Borrowing Strategy: Updates during FY 2025–26 Budget revisions.

Final Outlook

Tuesday’s RBI announcement deepens its proactive debt and liquidity management strategy, underscoring a commitment to responsible fiscal prudence, market stability, and measured monetary intervention. As the bond market and government borrowing plans evolve, this buyback will be closely watched for its ripple effects across interest rates, bank balance sheets, and investor sentiment, setting the tone for the fiscal and economic landscape ahead.