India Real Estate Round-Up – July 11, 2025

The Indian housing market continues to evolve rapidly—from safety-driven regulatory crackdowns to high-value residential investments by prominent figures and megaprojects launching in emerging cities. Today’s developments reflect the shifting priorities of buyers, developers, and regulators alike.

Telangana RERA Halts Hyderabad Project after Buyer Complaints

Hyderabad’s real estate watchdog, Telangana RERA, has taken decisive action by suspending the Shrivari’s Brundavanam housing project. Following multiple buyer complaints—ranging from unexplained delays to lack of promised amenities—RERA has prohibited the builder from selling any more flats in the development until the issues are resolved (turn0news19).

This move underscores the growing strength of state regulators in protecting consumer interests. As RERA adopts a stricter, more proactive stance, buyers across India are demanding faster resolution of grievances. The builder now faces compliance obligations, entailing detailed progress updates and a resolution timeline, or further financial and legal sanctions.

Zomato’s Deepinder Goyal Acquires ₹52 Crore Gurugram Penthouse

In the luxury segment, Deepinder Goyal, co-founder and CEO of Zomato, has made a high-profile addition to his real estate portfolio, recently registering a 10,813 sq ft penthouse at DLF Camellias, Gurugram, for ₹52.3 crore (stamp duty paid: ₹3.66 crore) (turn0news20).

DLF Camellias—one of the most exclusive residential projects in the region—has emerged as a hotspot for India’s affluent and corporate elite. Goyal’s acquisition reflects broader trends where India’s top entrepreneurs continue to invest in ultra-premium housing, reinforcing the resilience of this segment despite broader market cooling.

MP Growth Conclave to Showcase “Cities of Tomorrow” in Indore

Indore is gearing up for the Madhya Pradesh Growth Conclave—a major event themed “Cities of Tomorrow”—slated this Friday. Organized by the Indore Development Authority, the conclave aims to magnetize real estate, infrastructure, and smart-city investments worth ₹10,000 crore (turn0news21).

Over 1,500 delegates, including investors, developers, and industry experts, are expected to attend. The agenda covers urban mobility (EV buses, metro, ropeways), mixed-use projects, green buildings, digital services, and healthcare infrastructure. Five landmark projects—including office hubs, hotels, malls, and residential flats—will be unveiled. This event signals Madhya Pradesh’s shift from a small-town reputation to a regional economic powerhouse with aspirational urban growth.

Market Context: Growth, Regulation & Shifting Preferences

- Regulatory Oversight Strengthens: The case in Hyderabad is part of a wave. In neighbouring Karnataka, a special “Recovery Cell” was launched this week to enforce penalties and dues under RERA—signaling enhanced consumer protection across states (turn0news31).

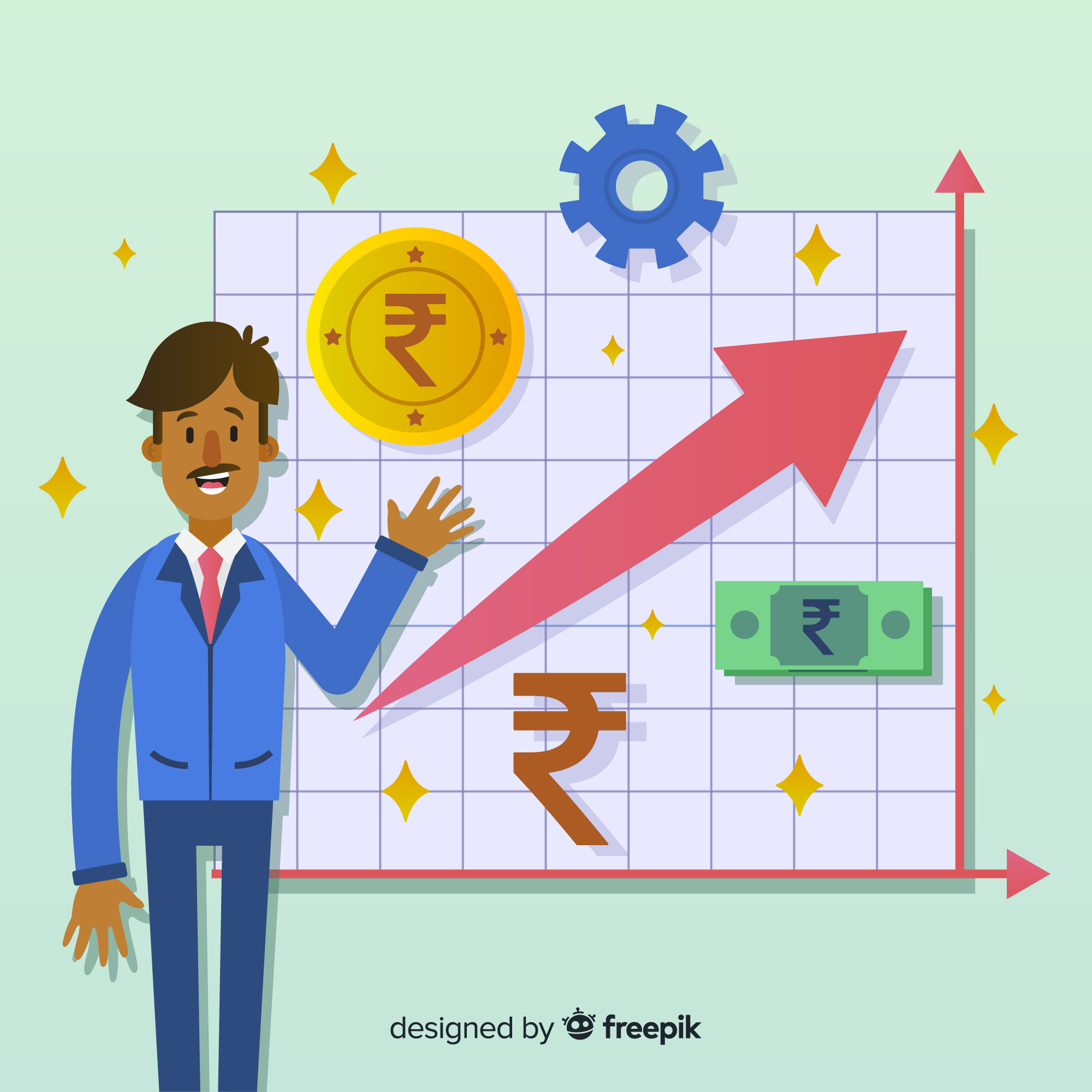

- Luxury Segment Holds Strong: Despite a reported 20% drop in overall home sales across top cities in Q2 2025, premium tier (₹1 crore +) continues to represent nearly 49% of sales in H1 2025 (turn0search16, turn0search8). High-net-worth buyers like Goyal are doubling down on trophy homes.

- Institutional & Domestic Investment Picks Up: Domestic capital infusion into real estate rose sharply—53% YoY to USD 1.4 billion in H1 2025—offsetting weak foreign inflows. Residential, office, and mixed-use were major beneficiaries (turn0search1).

- Boom in Tier‑2 Growth: Cities like Indore, Coimbatore, Lucknow, and Bhubaneswar are emerging as new hotspots. Indore is now actively courting capital through its growth conclave and eco-projects (turn0search13).

What This Means for Stakeholders

| Category |

Implications |

| Homebuyers | Enhanced confidence with more regulatory enforcement, higher-end properties remain aspirational |

| Developers | Must align with changing RERA expectations or face enforcement, luxury and infra-linked projects hold the edge. |

| Investors | Safe-haven housing (luxury, institutional-grade assets) continues to attract domestic capital amid global uncertainty |

| Policy makers | Events like MP Conclave reflect growing state-level push to drive urban investment and next-gen cities. |

Key Risks & Opportunities

Risks

- Delays due to stricter regulatory oversight or legal challenges

- Continued slowdown in mid- and affordable segments without policy intervention

Opportunities

- Scaling institutional affordable housing—the next wave could come from mixed-use and rental apartments

- Tier-2 city emergence attracting fresh investor interest

Final Thoughts

Today’s real estate landscape in India is marked by regulatory vigilance, luxury resilience, and renewed state-level investment push. From Hyderabad’s halted project to Gurugram’s luxury penthouse deals and Indore’s urban investment showcase, these developments emphasize a sector in transition.

The hardened approach from RERA and planned greenfield projects signal evolving market expectations. As developers, buyers, and policymakers recalibrate, the direction and speed of this adjustment will determine India’s real estate trajectory in the years ahead.